The Hang Seng Index indicates a notable recovery of the Hong Kong economy, with a 56.51% growth since January 2025. Investors are primarily focused on AI and electric vehicle (EV) stocks.

Mainland China’s commodity markets are also moving, as Alibaba stocks have surged 71% since the start of the year following the launch of DeepSeek AI, which is 96% more energy-efficient than other well-known GPTs.

Electric Vehicles Competition

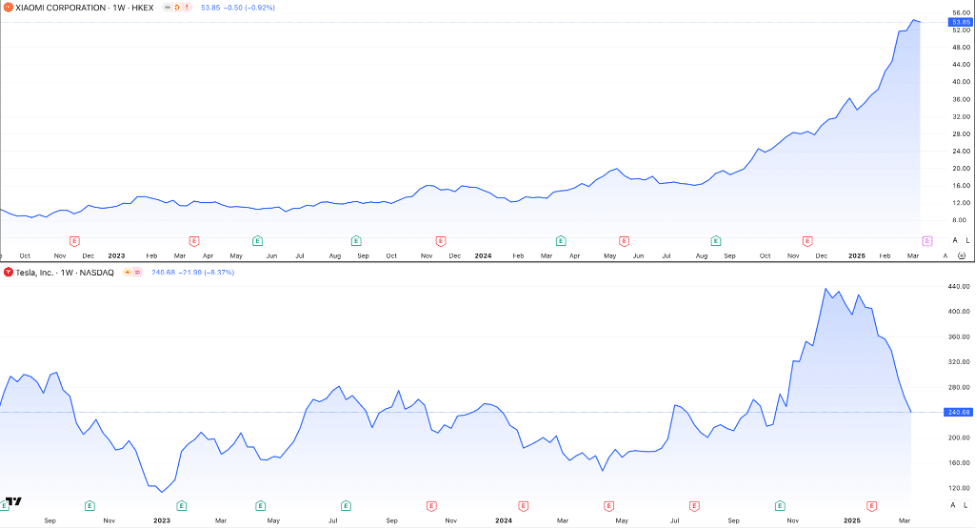

Meanwhile, Tesla is facing a promising new competitor. Xiaomi’s SU7 electric sedan, launched in March 2024, is selling 20,000 units per month, and the budget-friendly YU7 model is expected to launch in June-July 2025. A year after the first release of their electric vehicle, Xiaomi’s stock has surged by 260%.

Nonetheless, Xiaomi’s production is far from the approximately 153,148 units per month of Tesla. Despite their recent massive drop, Tesla stock price is up 37% over the same period as Xiaomi’s.

Another key player in the EV market, BYD, is close to outselling Tesla in 2025. They produce both fully electric vehicles and plug-in hybrid vehicles. As Tesla offers only fully electric vehicles, we’ll compare these two numbers.

In 2023, BYD and Tesla sold 1.52 million and 1.81 million EVs, respectively. In 2024, BYD managed to sell 1.76 million, while Tesla accounted for only 1.79 million.

Back in 2023, Elon Musk said, “Tesla’s playing checkers while BYD’s playing chess,” highlighting the Chinese manufacturer’s broader approach to the car market. Musk later added, “They’re not just chasing margins, they’re rewriting the rulebook on a scale.”

Beijing is focused on achieving “tech sovereignty.” Chinese advancements in the tech and EV sectors are welcomed by different types of investors. Despite the looming potential economic crisis in Europe, Chinese manufacturers see the EU as the main market for their EVs.

The Aftermath

The resurgence of the Hong Kong stock market, Xiaomi’s EVs, and BYD’s long-term approaches with the support of Beijing are just the tip of the iceberg in an expanding trade war.

Given the recent success in the automotive market, along with advancements in the AI sector, China can be considered the innovation engine for the mid-2020s.

As Jim Rogers, an American investor and financial commentator, said back in 2019: “The West invents, China iterates, and Hong Kong prices it all in. Right now, that’s where the smart money’s parked.”

But could all this growth be a bubble? It is possible, but one thing is clear: the future of the Chinese tech market is full of promise.