The financial landscape is undergoing a radical transformation driven by the rise of decentralized finance (DeFi). DeFi leverages blockchain technology to eliminate intermediaries, democratize access to financial services, and create more inclusive and transparent economic systems.

As the DeFi ecosystem expands, it offers myriad opportunities and challenges for developers, investors, and users alike.

This article delves into the intricacies of DeFi, outlining the steps involved in developing DeFi services, the benefits they offer, key considerations for selecting DeFi development services, the challenges faced, and the future prospects of DeFi.

What is DeFi?

Decentralized Finance DeFi, refers to a collection of financial applications built on blockchain technology, specifically Ethereum and other smart contract platforms.

Unlike traditional financial systems that rely on intermediaries such as banks and brokerages, DeFi operates in a decentralized manner, utilizing smart contracts to execute transactions and agreements automatically when certain conditions are met. This decentralization aims to provide more accessible, transparent, and efficient financial services.

Key Components of DeFi

1. Smart Contracts

These are self-executing contracts with the terms of the agreement directly written into code. They run on blockchain networks, ensuring that financial transactions are transparent, irreversible, and trustless.

2. Decentralized Applications (dApps)

These applications operate on decentralized networks, offering various financial services without centralized control. Examples include decentralized exchanges (DEXs), lending platforms, and insurance protocols.

3. Tokens

DeFi heavily relies on cryptocurrencies and tokens, which represent assets, rights, or access within the DeFi ecosystem. These tokens can be traded, lent, borrowed, or used as collateral.

How DeFi Works

DeFi platforms leverage blockchain’s distributed ledger technology to record transactions and smart contracts, which automatically execute predefined actions. Users interact with DeFi applications through wallets that connect to the blockchain, allowing them to trade, lend, borrow, or earn interest on their assets without the need for traditional banks or financial institutions.

Steps on DeFi Development Services

Creating a successful DeFi application requires a comprehensive understanding of blockchain technology, smart contract development, and user experience design. Here are the crucial steps involved in DeFi development services:

1. Ideation and Planning

a) Objective Setting

Define the primary objective of the DeFi project, whether it’s a decentralized exchanges dex, lending platform (I.e, flash loans), or another financial service.

b) Market Research

Conduct thorough research to understand the current market landscape, identify gaps, and determine the unique value proposition of the DeFi application.

c) Regulatory Considerations

Understand the regulatory requirements and compliance issues in different jurisdictions to ensure the DeFi application operates within legal frameworks.

2. Technical Architecture and Design

a) Blockchain Selection

Choose the appropriate blockchain platform (e.g., Ethereum, Binance Smart Chain, Solana) based on factors such as scalability, security, and ecosystem support.

b) Smart Contract Development

Design and develop smart contracts to automate the DeFi application’s core functions. Defi protocols are embedded in smart contracts. Ensure that these contracts are secure, efficient, and thoroughly tested.

c) User Interface (UI) Design

Create an intuitive and user-friendly interface that allows users to interact with the DeFi application seamlessly.

3. Development

a) Backend Development

Develop the backend infrastructure that supports the DeFi application, including APIs, databases, and servers.

b) Frontend Development

Build the frontend components of the DeFi application, ensuring a smooth and responsive user experience.

c) Integration

Integrate the smart contracts with the frontend and backend systems to ensure seamless operation.

4. Testing and Deployment

a) Security Audits

Conduct comprehensive security audits to identify and mitigate vulnerabilities in smart contracts and the overall system.

b) Beta Testing

Launch a beta version of the DeFi application to a limited audience to gather feedback and identify any issues.

c) Deployment

Deploy the DeFi application on the chosen blockchain network, making it accessible to the public.

5. Maintenance and Upgrades

a) Ongoing Support

Provide continuous support and maintenance to address any technical issues, security vulnerabilities, or user concerns.

b) Upgrades and Improvements

Regularly update the DeFi application with new features, enhancements, and security patches to stay competitive and secure.

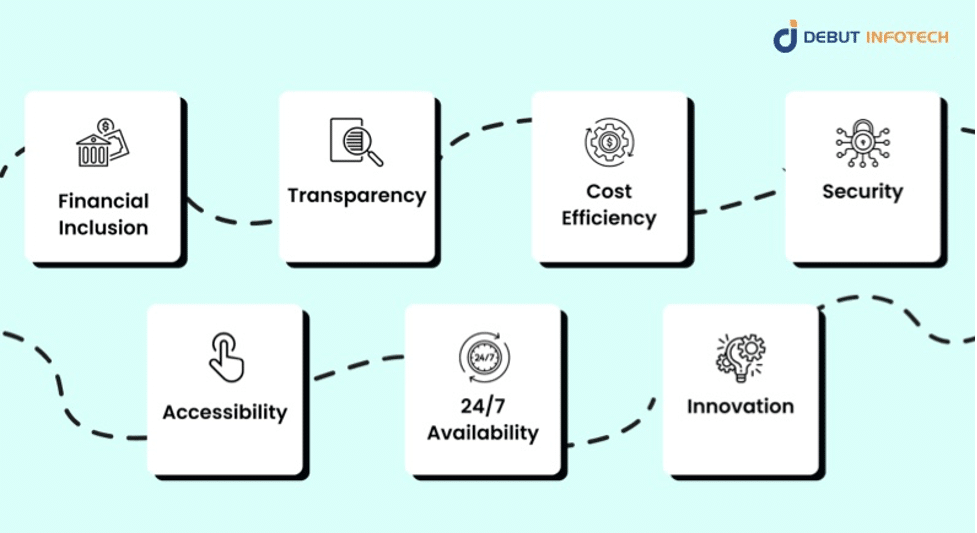

Benefits of DeFi Development Services

DeFi development services offer numerous advantages, transforming traditional financial systems and providing innovative solutions for various financial needs. Here are some key benefits:

1. Financial Inclusion

DeFi enables anyone with an internet connection to access financial services, irrespective of their location or socioeconomic status. This inclusivity empowers unbanked and underbanked populations to participate in the global economy.

2. Transparency

Blockchain technology ensures that all transactions are recorded on a public ledger, providing complete transparency and traceability. This transparency decreases the risk of fraud and enhances trust among users.

3. Cost Efficiency

By eliminating intermediaries, DeFi reduces transaction costs and operational expenses. Users can save on fees typically charged by banks, brokers, and other financial institutions.

4. Security

Smart contracts execute transactions (including peer to peer transactions) automatically based on predefined conditions, reducing the risk of human error and fraud. Additionally, blockchain’s decentralized nature makes it resilient to hacking and data breaches.

5. Accessibility

DeFi platforms operate on open networks, making financial services reachable to anyone with an internet connection. This inclusivity is particularly important for individuals in underserved or unbanked regions.

6. 24/7 Availability

DeFi platforms operate around the clock, allowing users to access and manage their digital assets anytime. This continuous availability contrasts with traditional financial institutions, which often have limited operating hours.

7. Innovation

As a blockchain based technology, DeFi fosters innovation by enabling developers to create new financial products and services. The open-source nature of blockchain technology encourages collaboration and experimentation, leading to continuous advancements in the DeFi space.

Factors to Consider When Choosing DeFi Development Services

Selecting the right DeFi development services is crucial for the success of a DeFi project. Here are some essential factors to consider:

1. Expertise and Experience

Choose a Defi development team with a proven track record in blockchain and DeFi development. Experienced developers are more likely to deliver high-quality, secure, and efficient solutions.

2. Reputation and Reviews

Research the provider’s reputation in the industry by reading reviews and testimonials from previous clients. Positive feedback and successful project outcomes indicate a reliable and competent service provider.

3. Security Measures

Security is paramount in DeFi development. Ensure the development team follows best practices for smart contract security, conducts thorough audits, and implements robust security measures.

4. Regulatory Compliance

Ensure the development team understands the regulatory landscape and can navigate compliance issues effectively. This includes knowledge of anti-money laundering (AML) and know-your-customer (KYC) requirements.

5. Technology Stack

Evaluate the technology stack used by the development team, including the blockchain platform, programming languages, and development tools. The chosen technology should align with the project’s requirements and goals.

6. User Experience

A seamless and user-friendly experience is crucial for the success of a DeFi application. The development team should prioritize intuitive design and usability for a positive user experience.

7. Cost and Timeline

Consider the cost and timeline for the development project. While staying within budget is important, prioritizing quality and security should not be compromised for cost savings.

8. Customization and Flexibility

Choose a provider that offers customization to meet your specific needs. A one-size-fits-all approach may not work for all projects, so ensure that the provider can tailor their services to your requirements.

Challenges of DeFi Development Services

Despite its numerous benefits, DeFi development services face several challenges that need to be addressed for successful implementation:

1. Security Risks

DeFi applications are attractive targets for hackers due to the significant value they hold. Smart contract vulnerabilities, phishing attacks, and other security breaches can result in substantial financial losses.

2. Regulatory Uncertainty

The regulatory environment for DeFi is still evolving, with different jurisdictions having varying approaches to regulation. Navigating this complex landscape can be challenging for developers and projects.

3. Scalability Issues

Blockchain networks, especially Ethereum, face scalability challenges, leading to high transaction fees and slow processing times during peak usage. Solutions like layer 2 scaling and alternative blockchains are being explored to address these issues.

4. User Adoption

While DeFi offers many advantages, mainstream adoption is still limited. User education and awareness campaigns are crucial to drive broader acceptance and usage of DeFi applications.

5. Interoperability

The DeFi ecosystem comprises various blockchains and protocols, creating interoperability challenges. Seamless interaction between different platforms is crucial for the ecosystem’s growth and efficiency.

6. Market Volatility

Cryptocurrencies and DeFi assets (I.e, yield farming) are subject to high volatility, which can impact the stability and usability of DeFi applications. This volatility poses risks for both developers and users.

Future of DeFi Development Services

The future of DeFi development services looks promising, with continued innovation and adoption expected in the coming years. Several trends and developments are likely to shape the future of DeFi. They are:

1. Enhanced Security Measures

As the DeFi ecosystem matures, security practices will continue to improve. Advanced auditing tools, formal verification methods, and multi-layered security protocols will become standard to safeguard DeFi applications.

2. Regulatory Clarity

Regulatory frameworks for DeFi are expected to evolve, providing clearer guidelines and standards for compliance. This regulatory clarity will foster greater confidence and participation in the DeFi space.

3. Interoperability Solutions

Efforts to enhance interoperability between different blockchains and protocols will gain momentum. Cross-chain bridges, atomic swaps, and other solutions will enable seamless interactions within the DeFi ecosystem.

4. Scalability Improvements

Scalability solutions, such as layer 2 protocols and alternative blockchains, will address the limitations of current networks. These improvements will reduce transaction costs and enhance the overall user experience.

5. Institutional Adoption

Institutional interest in DeFi is growing, with more traditional financial institutions exploring DeFi applications and partnerships. This trend will drive further innovation and integration of DeFi into the mainstream financial system.

6. Decentralized Governance

Decentralized autonomous organizations (DAOs) will play a more prominent role in the governance of DeFi projects. DAOs enable community-driven decision-making, enhancing transparency and accountability.

7. New Financial Products

The DeFi space will continue to see the development of novel financial products and services. Innovations such as decentralized insurance, synthetic assets, and yield optimization strategies will broaden the range of offerings available within the DeFi ecosystem. These new products will cater to diverse financial needs and attract a wider audience.

8. Integration with Traditional Finance

DeFi and traditional finance (TradFi) are likely to converge, creating hybrid models that combine the strengths of both systems. This integration will enable smoother transitions between decentralized and centralized financial services, giving users more flexibility and choice.

9. Improved User Experience

Future DeFi applications will prioritize user experience, making it easier for non-technical users to participate in DeFi. Enhanced interfaces, better educational resources, and simplified processes will lower the barrier to entry for new users.

10. Global Financial Inclusion

DeFi has the potential to significantly improve financial inclusion worldwide. By providing access to financial services in underserved regions, DeFi can empower individuals and communities, contributing to global economic development.

Conclusion

Decentralized finance is revolutionizing the financial industry by providing more inclusive, transparent, and efficient financial services. Through the development of DeFi applications, individuals and businesses can access a wide range of financial products without relying on traditional central authorities. The journey to creating a successful DeFi application involves meticulous planning, robust development, rigorous testing, and continuous improvement.

While DeFi offers numerous benefits, including financial inclusion, transparency, cost efficiency, and security, it also presents challenges such as security risks, regulatory uncertainty, scalability issues, user adoption hurdles, interoperability concerns, and market volatility. Addressing these challenges is crucial for the sustainable growth of the DeFi ecosystem.

Looking ahead, the future of DeFi development services is bright, with significant advancements expected in security measures, regulatory clarity, interoperability, scalability, and institutional adoption. The ongoing innovation and rise of DeFi will lead to the creation of new financial products, improved user experiences, and increased global financial inclusion.

As the DeFi landscape continues to evolve, developers, investors, and users must stay informed and adaptable. By leveraging the potential of DeFi, we can build a more decentralized, inclusive, and efficient financial system that benefits everyone.

Debut Infotech is a leading DeFi development company recognized for its expertise and innovative solutions in decentralized finance. With a dedicated team of blockchain experts, Debut Infotech excels in creating secure, scalable, and user-friendly DeFi applications tailored to your needs. Their comprehensive services include smart contract development, decentralized exchange (DEX) solutions, and DeFi wallet integration. Committed to transparency, cutting-edge technology, and regulatory compliance, Debut Infotech ensures top-tier DeFi platforms that enhance financial inclusion and efficiency. Partner with Debut Infotech to leverage the future of finance and transform your DeFi vision into reality with confidence.