Crypto Arbitrage Trading Strategies

Price discrepancies across different exchanges or even within the same exchange can create profit opportunities in cryptocurrencies. These discrepancies, even if they are for a few seconds, allow traders to buy low and sell high, earning a profit in the process. This is known as arbitrage trading. This article will dive into some of the prevalent crypto arbitrage trading strategies.

Triangular Arbitrage

Triangular arbitrage is a strategy that utilizes three distinct cryptocurrencies within a single exchange. Let’s dive into how this fascinating concept works:

- Start with one cryptocurrency, say Bitcoin (BTC).

- Use BTC to buy a second cryptocurrency, like Ethereum (ETH).

- Then, exchange ETH for a third cryptocurrency, maybe Ripple (XRP).

- Finally, convert XRP back to BTC.

- If done correctly and swiftly, you could have more BTC than you started with due to price discrepancies among the three coins.

Cross-Exchange (Hedge) Arbitrage

This is one of the most straightforward arbitrage strategies. It capitalizes on the price differences of a cryptocurrency on two different exchanges.

- Buy a cryptocurrency on Exchange A, where the price is lower.

- Simultaneously, sell it on Exchange B, where the price is higher.

- Transfer the proceeds back to Exchange A, ready for the next opportunity.

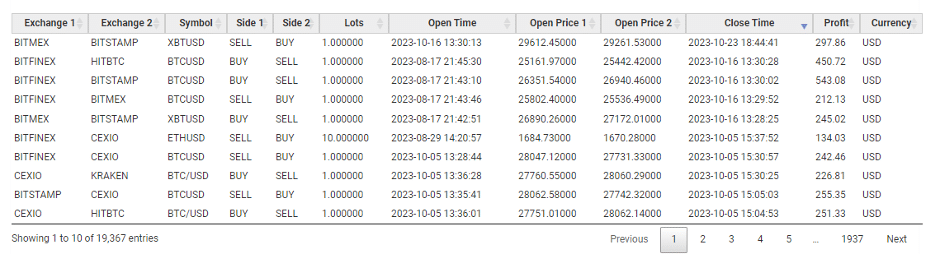

The key is the speed of execution, considering transfer times, transaction fees, and potential price slippages. Figure 1 shows an example of crypto arbitrage software trading (created by the BJF Trading Group) across several exchanges, such as BitMex, Bitfinex, Bitstamp, Cexio…

Fig. 1 – Cross-exchange arbitrage orders examples

Yield Arbitrage

With the advent of decentralized finance (DeFi), yield farming has become popular. Yield arbitrage focuses on the differences in interest rates or yields between different platforms.

- Lend or stake your cryptocurrency on Platform A, which offers a higher yield.

- Borrow the same cryptocurrency from Platform B at a lower interest rate.

- The difference between the interest earned and the interest paid is your profit.

Market Making

Market makers play a vital role in ensuring liquidity by strategically placing buy and sell orders. Their profits are derived from the bid-ask spread. By positioning a buy order below the market price and a sell order above it, they capitalize on the difference. Once both orders are executed, the market maker realizes a profitable spread.

This strategy requires a deep understanding of order book dynamics and often involves automated trading bots.

Trade Batching and Flash Loans Arbitrage

This advanced strategy is unique to the crypto world and involves leveraging sophisticated smart contract operations.

Trade Batching: Aggregate multiple trades into a single transaction to save on gas fees and exploit price discrepancies more efficiently.

Flash Loans: Borrow a large amount of cryptocurrency without collateral, use it for arbitrage, and repay the loan within the same transaction. This is possible due to the atomicity of blockchain transactions. The transaction is reverted if the arbitrage isn’t profitable, ensuring no loss.

Conclusion

While these arbitrage strategies sound enticing, they are not without risks. Transaction fees, transfer times, sudden market moves, and the inherent volatility of the crypto world can quickly turn potential profits into losses. Thus, it’s crucial to do thorough research, have a clear strategy, and maybe even consider using automated tools to help navigate the fast-paced world of crypto arbitrage.

Forex Arbitrage Trading Strategies

In the vast, liquid world of foreign exchange (Forex) trading, minute price discrepancies between different currency pairs or platforms can arise. These short-lived price differences allow traders to profit by buying a lower price and selling a currency pair at a higher price. This is the essence of arbitrage trading. Let’s delve into some of the most prominent Forex arbitrage trading strategies.

Triangular Arbitrage

Triangular arbitrage operates on the principle that, in theory, a given currency should have the same value regardless of how you trade it. This strategy involves three currency pairs, usually with the US Dollar (USD), and occurs within one exchange.

Start with a currency, say USD.

- Convert USD to a second currency, like the Euro (EUR).

- Use the EUR to purchase a third currency, perhaps the British Pound (GBP).

- Finally, convert GBP back to USD.

- If pricing inefficiencies exist among these conversions, you might have more USD than you began with.

Hedge Arbitrage

Hedge arbitrage is more about playing two brokers against each other. It’s based on the premise that there can be a delay in how quickly two brokers update their prices. When a significant news event hits, one broker might adjust the price of a currency pair faster than another. You simultaneously buy the currency pair from the slower broker and sell it to the faster broker.

Once the slower broker catches up, you can close out both positions for a profit.

Latency Arbitrage

Latency refers to the delay in the data transmission time. In high-frequency trading (HFT), a few milliseconds can make a significant difference.

Traders use advanced algorithms and high-speed trading systems to exploit tiny price differences that arise from latency.

Essentially, they’re capitalizing on the delayed price quotes from one broker or exchange, trading against real-time prices elsewhere.

Statistical Arbitrage

Statistical arbitrage is a bit more complex and involves mathematical modeling. It assumes that prices will eventually return to their historical mean or some other statistical measure.

By analyzing price differences and historical data, traders can identify currency pairs diverging from their expected values.

Traders will then buy the undervalued currency and short the overvalued currency, hoping for a convergence to the mean.

Swap Arbitrage

In Forex terms, the swap refers to the interest paid or earned for holding a currency pair overnight. Each currency has an associated interest rate, and traders can profit from the difference.

Let’s say a trader borrows a currency with a low interest rate and invests it in a currency with a higher interest rate.

The trader earns the difference between the interest earned and the interest paid, even if the value of the currencies doesn’t change.

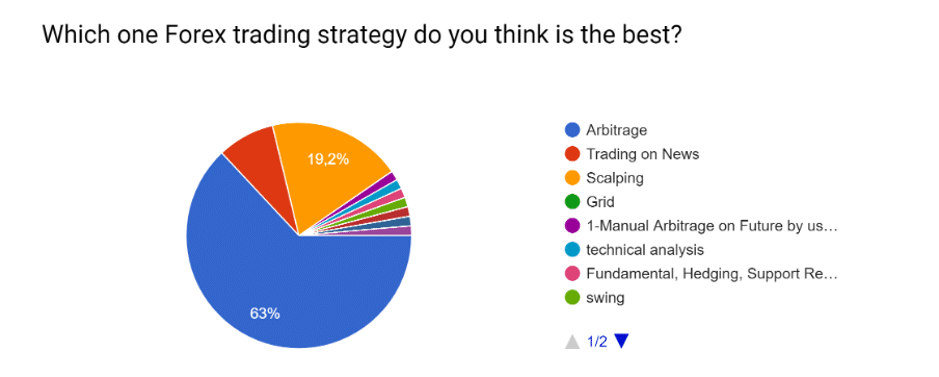

Fig 2. – Survey about Forex Trading Strategies (BJF Trading Group Clients)

Conclusion

Though appealing, Forex arbitrage trading strategies come with their challenges and risks. Factors such as transaction costs, broker policies, market volatility, and the ever-decreasing arbitrage opportunities, especially in well-developed markets, can influence profitability. Like any trading strategy, it’s vital to understand the nuances, risks, and potential rewards before diving in.

Forex Arbitrage vs. Crypto Arbitrage

Arbitrage is a strategy employed in various financial markets to exploit price discrepancies. It involves buying an asset in one market where the price is low and simultaneously selling it in another market where the price is high, thus profiting from the price difference. The Forex and cryptocurrency markets offer arbitrage opportunities, but the two have significant differences. Let’s compare Forex arbitrage and crypto arbitrage across several dimensions.

Market Maturity

- Forex: The foreign exchange market is one of the most mature and liquid markets globally, with a daily trading volume exceeding $6 trillion as of 2021. Its maturity means that arbitrage opportunities, especially straightforward ones, are rare and short-lived.

- Crypto: The cryptocurrency market, being relatively young and less regulated, often presents more frequent and broader arbitrage opportunities. This is especially true across different exchanges and regions.

Assets Involved

- Forex: Arbitrage here involves national currencies like USD, EUR, GBP, and others. Factors like interest rates, geopolitical events, and economic data influence the prices.

- Crypto: Arbitrage can involve cryptocurrencies like Bitcoin, Ethereum, and many altcoins. Technological updates, regulatory news, and overall market sentiment can influence prices.

Speed and Efficiency

- Forex: High-frequency trading (HFT) systems, banks, and institutional traders dominate the Forex market. These players use sophisticated algorithms to detect and act on arbitrage opportunities within milliseconds.

- Crypto: While algorithmic traders are in crypto, the market is less efficient than Forex. Hence, manual traders still have a chance to capitalize on arbitrage, especially between lesser-known exchanges or coins.

Risks

- Forex: The risks in Forex arbitrage are mainly associated with execution (not being able to trade quickly enough), broker policies, and system failures.

- Crypto: Besides execution risks, crypto arbitrage traders face other challenges. These include the risk of exchanges getting hacked, the withdrawal limits set by some platforms, and the relatively high transfer times for certain coins.

Costs

- Forex: Costs in the Forex market mainly include the bid-ask spread and, occasionally, commissions.

- Crypto: Costs in the crypto world can be more varied and include trading fees, withdrawal fees, blockchain transaction fees, and sometimes even deposit fees.

Accessibility

- Forex: The Forex market is generally accessible through major banks, brokers, and financial institutions. Some countries might have restrictions on Forex trading.

- Crypto: Cryptocurrencies can be traded on numerous exchanges worldwide. While there’s broader accessibility, some countries have stringent regulations or outright bans on cryptocurrency trading.

Conclusion

While both Forex and crypto arbitrage strategies aim to capitalize on price discrepancies, the nature, frequency, and potential profitability of these opportunities can differ substantially. Forex is a more mature and efficient market, which means arbitrage chances are slimmer and more fleeting. Conversely, with its relative inefficiency, the crypto market presents more frequent opportunities but with higher associated risks. Traders interested in either market should be aware of the nuances and intricacies of each to navigate them successfully.