Do you ever fantasize about gaining passive income while serving the animal kingdom? Veterinary practices can generate a steady stream of passive income while investing in providing an important, much-needed service that communities continually rely on.

Passive income is often associated with real estate, stocks, or bonds; however, when it comes to unique veterinary practices, these seem like minor hobby investments. But one of the least tapped areas is investment in veterinary practices. Both have a financial appeal and the reward of being part of an essential industry directly benefitting animals as well as their owners.

Status of the Veterinary Industry

Veterinary practices are one of the longest-standing stable growing industries. The increase in pet owners and the acknowledgment of pets as belonging to the family per se has placed increased demands on veterinary services. Consequently, veterinary clinics can be an attractive investment proposition for people looking to receive passive income.

Unlike more conventional ventures, veterinary practices offer a special advantage by being an essential service that would always be in constant demand, regardless of economic conditions. Pet ownership is continually increasing, and pets are living longer due to advances in medical care.

With pet owners eager to spend on their pets’ health, veterinary practices just keep on growing. This growth attracts steady streams of revenue and, over time, can bring a guide on selling a veterinary practice. When one invests in a veterinary practice, one is investing in a low-risk business: the need for veterinary services is not subject to the vicissitudes of market trends.

A major reason to invest in a veterinary practice is the fact that you can generate passive income. Unlike many other businesses, owners cannot be present managing their operations; in contrast, a veterinary practice can be operated very effectively by experienced veterinarians and staff.

This means that, as an investor, you will reap the rewards of the practice’s success without having to be involved in the day-to-day operations. Veterinary clinics are often managed by partners or owners who conduct the clinical and administrative activities of the practice.

Diversification of Investment Portfolio

Apart from generating passive income, investing in a veterinary practice allows the investment portfolio to diversify. Traditionally, people focus on stocks, bonds, and real estate when building their portfolios. Veterinary practice would be an alternative investment that offers diversification, meaning to break the risk associated with all being concentrated in one area.

The healthcare sector is known for its resilience, making veterinary services a solid addition to a diverse investment strategy. This diversification allows you to balance your investments and potentially weather economic downturns more effectively.

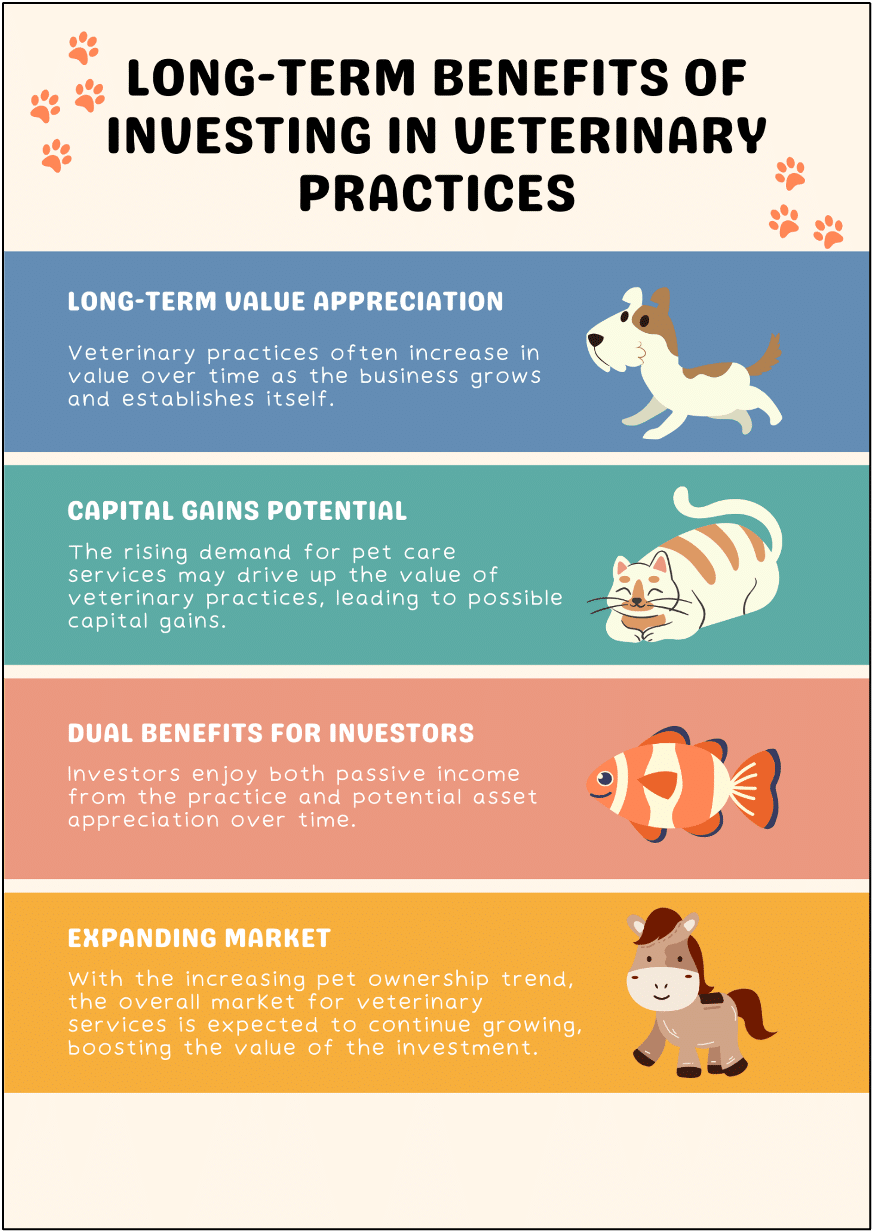

Long-Term Appreciation Potential

Investments in veterinary practices also hold a good prospect for long-term appreciation in value. The value of veterinary practices tends to be appreciated with the growth and establishment of veterinary practice businesses. Thus, that’s a good avenue for possible future capital gains. Moreover, the increase in pet ownership and high-end pet care services might also drive up the value of veterinary practices in the future.

As an investor, you benefit not only from the income generated by the practice but also from the appreciation of the value of the asset over time. This represents both a potential for passive income and capital gain: it is a very appealing long-term investment. The market for pet care is expected to continue expanding, so your investment in a veterinary practice is likely to rise in value not only in the revenue it produces but also due to the overall growth of the business.

Sense of Community and Engagement

The relationship between the investor and the practice is another appealing feature of this type of investment. Many veterinary practices feel like a community, where investors can be part of business decisions, attend meetings, or even participate in charity initiatives. It is satisfying to know that your investment goes straight towards the betterment of animals’ health and well-being.

For those who want to be more deeply involved, some practices allow investors to have their say in business strategies or expansion plans. This unique combination of passive income and the potential for active involvement is very scarce in most other investment opportunities. Investors can benefit from income but not necessarily be invested in the day-to-day operations.

Low Barriers to Entry

Another advantage of investing in this particular sector is being able to have low barriers to entry. Unlike other healthcare investments, which may require a lot of knowledge in the field or capital, veterinary practices might be more available.

An investor with proper research and due diligence, therefore, can get veterinary clinics that are well-established and profitable with relatively low risks. In addition, partnerships and ownership structures are often flexible so that investors can easily find one that suits their goals and financial situation.

Recession-Proof Investment

Veterinary practices are also regarded as a recession-proof investment. Some industries decline during recessions, but this is rarely so for veterinary services. This is because pet owners are always willing to spend money on the healthcare of their pets, regardless of economic conditions.

The fact that pet owners treat their pets like family makes this understandable. Stability provides an attractive choice for investing in a business whose cash flow is reliable. Indeed, among many services, pet care services have proved to be resilient and to grow during economic recessions.

Risks and Due Diligence

Like any investment, investing in a veterinary practice comes with risks. Market conditions, management quality, and competition from other clinics can affect the performance of the practice. It is thus essential to conduct thorough research and partner with those with experience in veterinary investments.

Seeking guidance from a financial advisor or investment consultant can help mitigate risks and maximize returns. With careful selection of a well-managed and well-positioned veterinary clinic, the risks are minimal and your investment will bear fruit.

Rewarding Investment

The long-term benefits despite the risks involved make investing in veterinary practices almost impossible to ignore with the stability of the industry, passive income, and long-term appreciation potential in veterinary practices.

For investors interested in positive impact while generating an income, investing in a veterinary practice is a way to both achieve financial success and value your investments. Diversifying your investments while tapping into a growing industry can create a steady income stream that supports both your financial goals and your values.

Conclusion

Whether you’re looking to diversify your income or simply invest in a business with long-term potential, veterinary practices present an opportunity that combines financial growth with a meaningful impact.

The steady demand for veterinary services, coupled with the potential for passive income, makes this investment a smart choice for those seeking to balance their portfolio with a reliable, recession-proof industry. So, if you’re looking for an investment that offers both financial rewards and personal satisfaction, a veterinary practice may be the perfect fit for you.

FAQs

1. Is investing in a veterinary practice a stable income source?

Yes, it’s a stable income source due to the consistent demand for veterinary services driven by pet care needs.

2. Do I need to actively manage the veterinary practice after investing?

No, the daily operations are managed by staff, allowing you to earn passive income.

3. What are the risks of investing in veterinary practices?

Risks include market conditions and competition, but thorough research and good management can minimize them.