Businesses currently encounter taxation as one of their most intricate operational difficulties. Businesses must carefully maintain financial records to comply with complex tax laws and regulations set by city governments.

Improper tax management leads companies to unexpected tax issues which result in severe financial and legal consequences. Organizations can adopt smart bookkeeping practices early to prevent these challenges and ensure compliance and financial stability.

Making Your Bookkeeping Smarter

Smart bookkeeping is more than just recording transactions it’s about maintaining a well-structured financial system that ensures compliance, optimizes deductions, and supports business growth. Whether you’re a startup, a small business, or an established company, effective bookkeeping strategies help you stay ahead by providing accurate financial insights and preventing costly mistakes.

When subscribing to trusted bookkeeping services in austin, companies can leverage local expertise to navigate both federal and Texas-specific tax regulations. These professionals offer tailored solutions that align with the unique financial landscape of Austin-based businesses.

The process of tax compliance requires precise bookkeeping as its foundation. The Inter-American Development Bank conducted research that found that organized books affect tax filing accuracy and minimize reporting errors. The evolving market demands proper implementation of smart bookkeeping techniques because it reduces tax-related threats.

The Role of Accurate Financial Records

Maintaining precise financial records is essential for several reasons. First, it ensures that all income and expenses are accurately reported, which is critical for determining tax liabilities. Inaccurate records can lead to underreporting income or overstating deductions, both of which can trigger audits and penalties from tax authorities. Additionally, incorrect filings can result in tax overpayments, meaning businesses pay more than necessary.

Second, detailed financial records provide a clear audit trail. In the event of an audit, businesses must present comprehensive documentation to substantiate their tax filings. Without proper records, companies may face difficulties defending their positions, leading to unfavorable outcomes. Organized bookkeeping minimizes discrepancies, ensuring that businesses remain compliant while avoiding unnecessary financial strain.

The Risks of Poor Bookkeeping in Tax Compliance

Failure to implement a smart bookkeeping system can result in several challenges that place businesses at risk. Some of the most common consequences include:

- Missed tax deadlines – Filing late can result in penalties and interest charges that accumulate over time.

- Inaccurate tax reporting – Errors in financial statements can trigger audits and legal complications.

- Cash flow issues – Poor record-keeping can make it difficult to anticipate upcoming tax liabilities, leading to financial shortfalls.

- Loss of deductions – Poor record-keeping may prevent businesses from claiming all eligible deductions, increasing their tax burden.

To avoid these pitfalls, businesses must establish a bookkeeping system that prioritizes accuracy, consistency, and proactive financial planning.

Leveraging Technology in Bookkeeping

The integration of technology into bookkeeping processes has revolutionized financial management. Automated systems reduce the likelihood of human error, ensure real-time data entry, and streamline the reconciliation of accounts. Utilizing advanced bookkeeping software allows businesses to maintain up-to-date records, facilitating timely and accurate tax filings.

Moreover, cloud-based bookkeeping solutions offer accessibility and scalability. Businesses can access their financial data from anywhere, ensuring compliance with tax obligations as they grow. This flexibility is particularly beneficial for startups and small businesses aiming to scale operations without compromising financial accuracy.

Some of the key features of modern bookkeeping software include:

- Automated tax calculations – Ensures accurate tax reporting and minimizes the risk of filing errors.

- Expense tracking and categorization – Helps businesses monitor spending patterns and claim eligible deductions.

- Integration with payroll and invoicing systems – Simplifies financial management and ensures consistent record-keeping.

By incorporating technology into bookkeeping, businesses can streamline their financial processes while reducing the risk of unexpected tax issues.

Regular Financial Reviews and Reconciliations

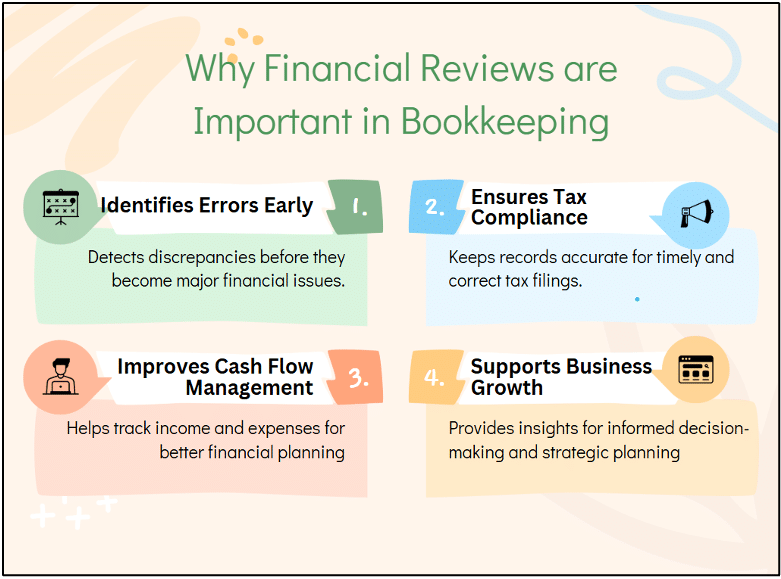

Consistent financial reviews are a cornerstone of smart bookkeeping. Regularly reconciling bank statements, reviewing expense reports, and assessing financial statements help identify discrepancies early. Addressing these issues promptly prevents minor errors from escalating into significant tax problems.

Additionally, periodic financial assessments enable businesses to stay informed about their financial health. Understanding cash flow patterns, profit margins, and expense trends allows for informed decision-making, ensuring that companies can meet their tax obligations without financial strain. Business owners who conduct monthly or quarterly financial reviews are better positioned to make proactive adjustments, rather than reacting to financial crises.

Tax Planning and Forecasting

A key benefit of smart bookkeeping is the ability to engage in strategic tax planning. Rather than waiting until the end of the fiscal year to assess tax liabilities, businesses should forecast tax obligations in advance. This allows for better financial preparation and ensures that companies have the necessary funds to cover their tax responsibilities.

Tax forecasting involves:

- Analyzing past tax payments – Identifying trends in tax liabilities to predict future obligations.

- Identifying potential deductions – Ensuring businesses take advantage of tax-saving opportunities.

- Budgeting for tax payments – Allocating funds throughout the year to avoid financial shortfalls.

Proper tax planning reduces financial stress and positions businesses to remain compliant without last-minute surprises.

Engaging Professional Bookkeeping Services

While technology and internal practices are vital, the expertise of professional bookkeepers cannot be overstated. These professionals possess a deep understanding of tax laws and regulations, ensuring that businesses remain compliant. In Austin, numerous reputable bookkeeping services offer specialized knowledge of both local and federal tax codes, providing invaluable support to businesses aiming to prevent unexpected tax issues.

Engaging professional services also allows business owners to focus on core operations. By entrusting financial management to experts, companies can allocate more time and resources to growth and development, confident that their tax obligations are in capable hands. Additionally, bookkeeping professionals provide ongoing support for financial planning, ensuring businesses remain on track year-round.

Best Practices for Preventing Tax Issues

To maintain tax compliance and financial stability, businesses should implement the following best practices:

- Maintain detailed records – Keep track of all financial transactions, including invoices, receipts, and payroll records.

- Monitor tax deadlines – Establish reminders for tax filings and estimated tax payments.

- Separate business and personal finances – Maintain separate bank accounts to ensure clarity in financial reporting.

- Use professional bookkeeping services – Leverage expert assistance to navigate complex tax laws.

- Stay updated on tax regulations – Monitor changes in tax laws that may impact business finances.

Implementing these best practices significantly reduces the risk of unexpected tax complications.

Conclusion

Preventing unexpected tax issues requires a proactive and informed approach to financial management. By implementing smart bookkeeping practices, leveraging technology, conducting regular financial reviews, and engaging professional services, businesses can navigate the complexities of taxation with confidence. In the dynamic economic landscape of Austin, adopting these strategies not only ensures compliance but also positions companies for sustained success and growth.

By subscribing with bookkeeping services in Austin, business owners gain the financial clarity needed to prevent tax issues before they arise. Prioritizing structured bookkeeping ensures compliance, minimizes risk, and fosters long-term financial health.

Frequently Asked Questions (FAQs)

- How can smart bookkeeping prevent tax penalties?

By maintaining accurate and up-to-date financial records, smart bookkeeping ensures compliance with tax laws, reducing the risk of errors that could lead to penalties. - What are the benefits of outsourcing bookkeeping services in Austin?

Outsourcing provides access to local expertise in tax regulations, ensures accurate financial management, and allows business owners to focus on core activities. - How does technology enhance bookkeeping accuracy?

Advanced bookkeeping software automates data entry and reconciliation, reducing human error and ensuring real-time financial tracking.