Decentralized Finance (DeFi) has grown into a multi-billion dollar industry in the past decade. Despite several issues facing this new industry, it has continued to grow, even during the darkest moments in crypto history. Leading dApps like AAVE and yearn.finance have attracted billions of dollars in capital and demonstrated the potential of DeFi to revolutionize traditional finance.

However, DeFi still faces challenges that hinder its widespread adoption. Scalability remains a major concern, with many existing blockchain platforms struggling to handle the increasing volume of DeFi transactions. This can lead to network congestion, high fees, and slow confirmation times, creating a barrier for mainstream users.

BlockDAG aims to address these challenges with its high-performance blockchain architecture, which is explicitly designed to support the growing demands of the DeFi ecosystem. Its unique consensus mechanism and accessible mining infrastructure, which includes tools like the crypto mining calculator to help users estimate potential returns, make it a viable platform for DeFi developers and users.

This article will explore how BlockDAG is engineering a blockchain for the future of finance, examining its potential to overcome the limitations of current DeFi platforms and contribute to a more secure, scalable, and accessible decentralized financial system.

Is The Future of Finance Decentralized?

For many years, traditional finance, also known as TradFi, showed no interest or concern for DeFi. However, recent times have changed everything. Some of the most notable financial institutions, such as BlackRock and Fidelity, are now directly exposed to crypto, and billions of dollars are now lent and borrowed on dApps like Aave.

Decentralized finance, or DeFi, aims to recreate traditional financial systems in a decentralized manner, using blockchain technology to eliminate intermediaries and provide greater transparency and accessibility. Instead of relying on banks and other centralized institutions, DeFi utilizes smart contracts and decentralized platforms to facilitate financial transactions.

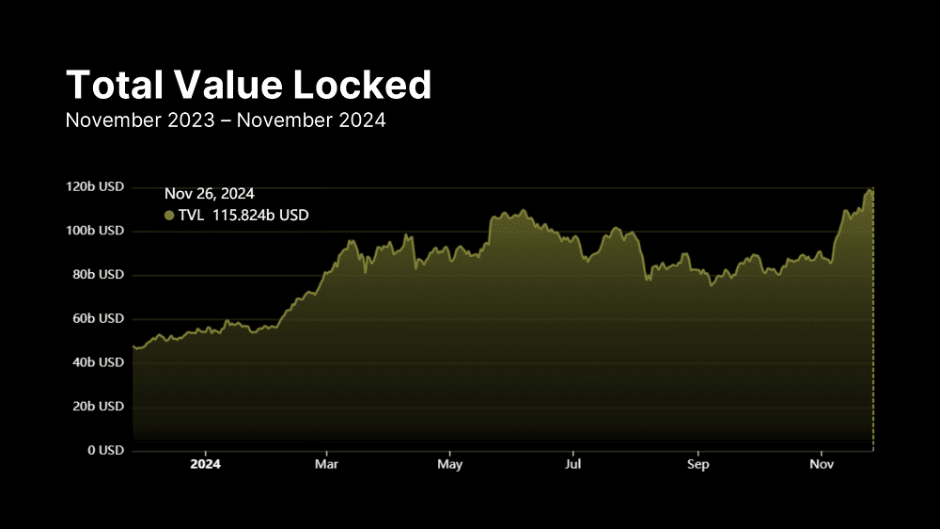

DeFi has witnessed substantial growth, with DeFiLlama reporting over $115 billion in total value locked (TVL) across various networks, with a large chunk accumulated by DeFi protocols. This growth is fueled by the increasing popularity of dApps like Aave, a decentralized lending and borrowing platform, and yearn.finance, a yield aggregator that helps users maximize returns on their crypto assets. These platforms offer users greater control over their finances and access to innovative financial products often unavailable in traditional systems.

While the future of finance may indeed be decentralized, DeFi still faces challenges that need to be addressed before mass adoption can occur. Scalability remains a major concern, as many existing blockchain platforms struggle to handle the growing volume of DeFi transactions. This can lead to network congestion, high fees, and slow confirmation times, hindering user experience and limiting the potential for mainstream adoption.

The total value locked across all networks exceeds $115 billion, and a large part of this is in DeFi protocols. Source: DeFiLama

BlockDAG: Solving the Issues Preventing DeFi from Reaching the Masses

The BlockDAG vision has fully accounted for the potential of DeFi while also taking aim directly at its current limitations. It seeks to provide the infrastructure necessary for DeFi to reach its full potential and achieve widespread adoption.

One of the key challenges facing DeFi is scalability. Many existing blockchain platforms, such as Ethereum, struggle to handle the growing volume of DeFi transactions. This can lead to network congestion, high transaction fees, and slow confirmation times, creating a barrier for mainstream users and hindering the growth of the DeFi ecosystem.

BlockDAG addresses this challenge with its high-performance architecture, which combines blockchain and directed acyclic graph (DAG) technology. This hybrid consensus mechanism allows BlockDAG to process transactions concurrently, resulting in significantly faster confirmation times and greater throughput compared to traditional blockchains. This scalability is essential for supporting the complex and demanding applications that are present in the DeFi space.

Security is another critical concern in the DeFi landscape. Numerous exploits and hacks have highlighted the vulnerabilities of some DeFi protocols and platforms. BlockDAG prioritizes security, incorporating cryptographic algorithms and a robust consensus mechanism to protect the network and its users from attacks. This commitment to security is crucial for building trust and confidence in the DeFi ecosystem.

Final Thoughts on BlockDAG and the Future of Finance

Decentralized finance (DeFi) has experienced remarkable growth in recent years, attracting billions of dollars in capital and demonstrating its potential to revolutionize traditional financial systems. However, DeFi still faces challenges, such as scalability and security limitations, that hinder its widespread adoption.

BlockDAG offers a promising solution to these challenges. Its high-performance architecture, combining blockchain and DAG technology, provides the foundation for a more scalable, secure, and accessible DeFi ecosystem. BlockDAG’s commitment to addressing the current limitations of DeFi could pave the way for its mass adoption and contribute to a more inclusive and efficient financial future.