As the digital gold rush continues with Bitcoin at the forefront, its mining practices have come under scrutiny. Addressing both economic and environmental concerns, the world seeks answers on the efficiency and sustainability of Bitcoin mining. So, if you are interested in Bitcoin investment, you may consider knowing aboutDeFi’s pivotal role.

Current Bitcoin Mining Landscape

In today’s digital world, the Bitcoin mining landscape has undergone significant transformation. Gone are the days when individuals could mine Bitcoin using just their personal computers. Instead, the current scenario is dominated by powerful, specialized equipment and a dynamic mix of energy resources.

One of the most notable shifts in the Bitcoin mining landscape is its geographical distribution. Historically, China was the epicenter of Bitcoin mining, but recent regulations and energy concerns have pushed miners to explore other regions. Countries with cheap and abundant electricity, especially those relying on hydroelectric power, have become hotspots for mining operations. Places like Kazakhstan, Russia, and parts of the United States have seen a rise in mining activities.

Energy sources for Bitcoin mining have been a focal point of discussion, especially concerning the environment. The narrative that Bitcoin mining heavily relies on coal and other non-renewable resources is shifting. A growing number of miners are transitioning to renewables, with solar and wind energy becoming more prevalent in mining operations.

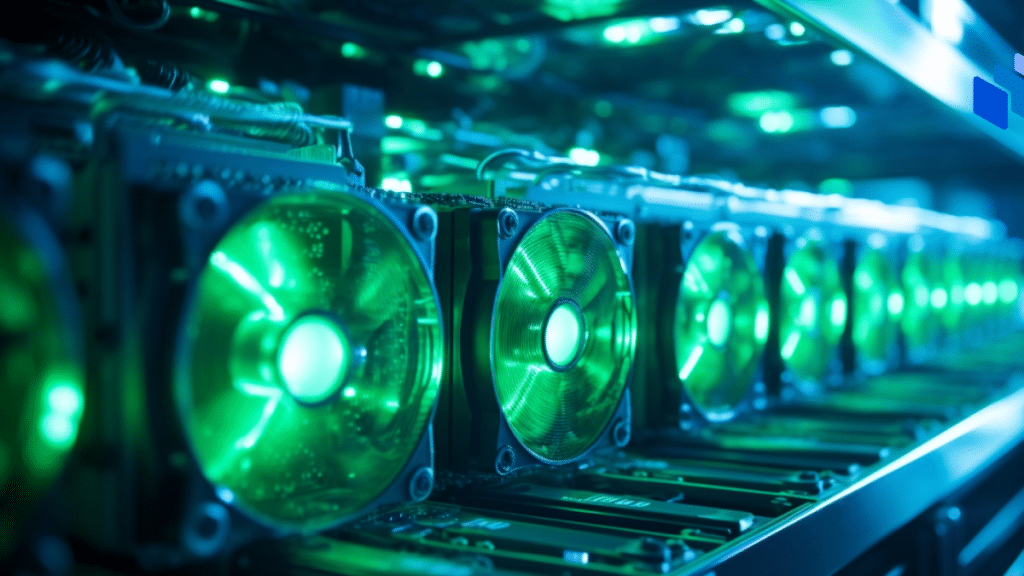

Another fascinating evolution in the Bitcoin mining landscape is the advancement in cooling solutions. Mining Bitcoin produces a significant amount of heat, which, if not managed, can reduce the efficiency of the mining rigs and lead to hardware malfunctions. Modern mining operations have implemented advanced cooling technologies, ensuring that equipment runs optimally.

The Economic Angle

Diving into the economic aspects of Bitcoin mining reveals a balancing act of costs and rewards that determine its profitability. Mining’s primary expense is electricity. With energy-intensive machines running round the clock, the electricity bill can quickly escalate, making the location of mining operations, and the cost of power in those regions, paramount to success.

Historically, when Bitcoin was in its infancy, the rewards for mining far outstripped the costs. Miners reaped substantial profits as the relative ease of mining combined with rising Bitcoin prices resulted in a lucrative endeavor. However, as more miners entered the fray, the Bitcoin network’s in-built difficulty adjustment ensured that mining became progressively harder, pushing the break-even point higher.

This interplay of increasing difficulty and fluctuating Bitcoin prices has led to periods where mining becomes less profitable, especially for small-scale operations. In contrast, large-scale mining farms, with access to cheaper electricity and more efficient equipment, can weather these economic storms with greater resilience.

Another economic factor in play is the rise of large mining pools. These pools aggregate the hashing power of multiple miners, increasing the chances of solving the complex mathematical problems required to add a block to the blockchain. While joining a mining pool reduces the unpredictability of rewards, it also means that the rewards are split among more participants. This has led to concerns about the decentralization of the Bitcoin network, as a few large pools could potentially control a significant percentage of the network’s total hashing power.

The Environmental Perspective

The environmental implications of Bitcoin mining have become a central conversation point, especially given the increasing scrutiny on global carbon footprints. Historically, the energy-intensive nature of Bitcoin mining drew criticism for its perceived negative impact on the environment, primarily when mining operations relied on non-renewable energy sources.

A significant chunk of Bitcoin mining previously occurred in regions where coal was a primary energy source. This reliance on coal exacerbated the environmental concerns, with critics highlighting the considerable CO2 emissions attributed to such mining operations. However, this narrative has been changing.

With increased awareness and emphasis on sustainable practices, many mining operations are making a conscious effort to switch to greener alternatives. Renewable energy sources, like hydroelectric, wind, and solar, are playing a more prominent role in powering mining rigs.

Regulations and global policies have further emphasized the importance of sustainable mining. Several governments and international bodies have instituted guidelines and standards to reduce the carbon footprint of Bitcoin mining. These regulations, combined with market-driven forces and community-driven initiatives, are ushering in an era of ‘green mining.’ Miners now recognize that long-term sustainability necessitates environmentally-friendly practices, not just from a regulatory standpoint but also as a means to ensure broader acceptance and integration of Bitcoin into mainstream financial systems.

Conclusion

Bitcoin mining’s trajectory illustrates a blend of innovation, adaptability, and a drive towards sustainability. As the industry matures, the focus remains on balancing profitability with environmental responsibility, ensuring a brighter future for this decentralized currency.