In the face of global technological rivalry and the United States’ desire to strengthen its position in the semiconductor sector, Nvidia is taking a decisive step: the company is launching production of its flagship AI chips in the United States.

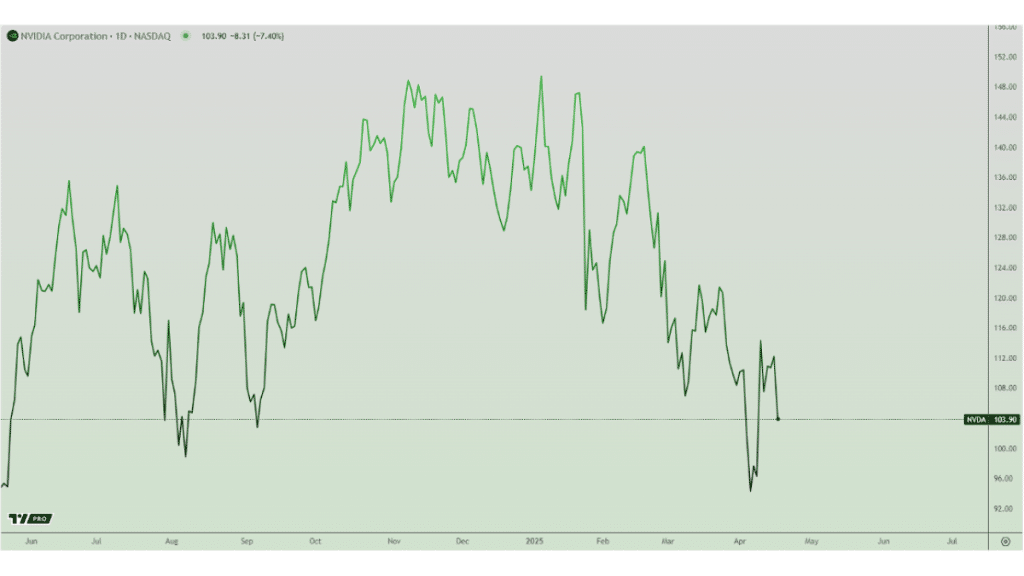

After a recent brutal correction, Nvidia stock seems to have rebounded as the company plans to invest hundreds of billions of dollars in developing artificial intelligence infrastructure in the United States in the coming years. It also aims to strengthen cooperation with key partners and create new jobs.

Nvidia has started production of Blackwell GPUs at the TSMC factory in Phoenix, Arizona. This marks an important step, as the vast majority of the company’s chips were previously manufactured in Asia. At the same time, Nvidia announced the formation of joint ventures with leading contract manufacturers:

● Foxconn, a Houston-based producer of accelerators and server systems for Nvidia chips.

● Wistron, a Dallas-based joint venture focused on producing high-performance AI solutions.

Nvidia has signed contracts with Amkor and SPIL for chip packaging and testing, ensuring a complete production cycle within the United States. The company has already commissioned more than 93,000 m² of production and testing facilities in Arizona and Texas, demonstrating the commitment to localizing supply chains.

Unlike AMD, which has yet to announce similar large-scale projects in the United States, Nvidia intends to launch mass production of accelerators and server systems at facilities in Houston and Dallas within 12–15 months. While Nvidia accelerates its U.S. expansion, AMD stock price hovers around $100, reflecting investors’ concern amid the company’s more measured approach.

More importantly, Nvidia’s long-term strategy is clear: it plans to invest up to $500 billion in AI infrastructure in the United States over the next four years.

These investments will be directed toward:

● Construction of new data centers

● Development of production facilities in collaboration with TSMC, Foxconn, and Wistron

● Support of national semiconductor industry initiatives under the CHIPS Act.

Nvidia is not the only company seeking support from the U.S. administration. With tighter export restrictions and Washington’s goal to reduce reliance on Asian suppliers, other industry players are also becoming more proactive.

OpenAI, SoftBank, and Oracle have announced a joint $500 billion data center project in the United States. Microsoft plans to invest $80 billion in AI infrastructure in the fiscal year 2025, with half of that amount allocated to data center construction in the United States.

Moving production to the United States is a response to geopolitical challenges and a strategic move to strengthen Nvidia’s position in the face of growing demand for AI chips. The company follows the trend and sets the pace, promising to invest half a trillion dollars in American infrastructure.

If Nvidia’s plans come to fruition, they could significantly change the balance of power in the semiconductor industry, reducing U.S. dependence on TSMC in Taiwan and Samsung in South Korea. In the future, this could also accelerate the development of the national AI ecosystem, which aligns with the White House’s strategic objectives.

Nvidia claims that its chip manufacturing initiatives in the United States could create hundreds of thousands of jobs and generate trillions of dollars in economic activity over the coming decades. However, programs to increase chip production in the United States face significant challenges.

Retaliatory tariffs and trade restrictions from China pose threats to the supply of critical raw materials, as there is a qualified personnel shortage. Moreover, actions by the Trump administration to repeal the CHIPS Act, adopted in 2022, may scare off future investors.

The question remains: Will AMD and other players propose equally ambitious plans? So far, Nvidia seems to be the primary beneficiary of the new “silicon sovereignty” era in the United States.