Now that cryptocurrencies are gaining more and more traction, more people are getting into the world of investing in blockchain projects. Therefore, it is essential to stress the importance of adopting sound investment strategies. Risk management is crucial for professional investors, and price volatility is one of the biggest risks in cryptocurrency trading. In particular, the most significant risk, especially for traders, is that unexpected news, such as a hack or a blockchain disruption, can cause a rapid decline of an individual cryptocurrency. One of the most efficient ways to avoid this is through Crypto Tradable Indices. These indices include different groups of cryptocurrencies; for example, Traxk’s Top 10 Proof of Stake Index encapsulates the top 10 blockchains based on the PoS protocol, weighted by market capitalization. For a beginner, but also a full-time trader, these crypto index funds may be the right solution:

- Crypto Tradable Indices can be purchased either through fiat currencies or cryptocurrencies.

- Unlike crypto ETFs, trading is possible 24 hours a day, 365 days a year.

- They allow easy diversification and categorization of your investments, significantly decreasing the volatility of individual investments.

- Experienced fund managers automatic rebalance indices rebalancing following strict rules.

- There are over 20 CTIs, and you can choose the crypto index funds that best suit your risk tolerance, time perspective, investment objectives, and trading strategy.

What Are Crypto Tradable Indices?

At their core, Trakx Crypto Tradable Indices (CTIs) are proprietary crypto baskets and function similarly to traditional financial indices, such as stock market indices like the S&P 500. However, instead of comprising stocks of individual companies, these crypto index funds consist of a weighted selection of cryptocurrencies. This selection process typically considers factors such as market capitalization, fundamental analyses, and regulatory aspects.

How Do They Work?

Crypto indices are built using a methodology that determines the composition and weightings of the constituent cryptocurrencies. This methodology may vary depending on the index, but most involve a rules-based approach or algorithmic rebalancing mechanism. By rebalancing regularly, these indices ensure that they accurately reflect changes in the cryptocurrency market, maintaining their relevance and effectiveness as investment instruments.

What is The Main Advantage?

One of the primary advantages of investing in Crypto Tradable Indices is their inherent diversification. Diversification is a fundamental principle of investing that aims to reduce risk by spreading investments across different assets. Investing in a basket of cryptocurrencies rather than a single asset can minimize the impact of adverse price movements in any individual cryptocurrency, thereby mitigating overall portfolio risk.

Most Suitable Crypto Index Funds for Your Characteristics

Selecting the right crypto index funds tailored to your individual characteristics, preferences, and investment goals is crucial for building a successful and diversified portfolio. With many options available in the market, conducting thorough research and analysis is essential to identify the most appropriate index funds for your specific needs. Here’s a closer look at how you can determine which crypto index funds are best suited to your characteristics:

Risk Tolerance

Your risk tolerance plays a significant role in determining the most suitable crypto index funds for your portfolio. If you have a low-risk tolerance and prioritize capital preservation, you may opt for conservative index funds with exposure to established cryptocurrencies like the Bitcoin Ethereum 50/50 Crypto Index. These funds typically offer stability and lower volatility, making them suitable for risk-averse investors. On the other hand, if you have a higher risk tolerance and are comfortable with market fluctuations, you may consider more aggressive index funds with exposure to emerging cryptocurrencies or niche sectors within the crypto market, such as the Artificial Intelligence Crypto Index Fund. These funds have the potential for higher returns but come with increased volatility and risk.

Investment Objectives

Your investment objectives should also guide your selection of crypto index funds. Whether you’re seeking capital appreciation, income generation, or a combination of both, there are index funds available to align with your goals. For investors focused on long-term growth, index funds like the Top 10 DeFi Crypto Index, with exposure to high-growth sectors like Decentralized Finance or emerging technologies, may be appealing. These funds offer the potential for significant returns over time but may experience higher volatility in the short term. If your objective is to generate income from your investments, you may consider index funds tied to income-generating assets like decentralized lending platforms or dividend-paying cryptocurrencies (staking). These funds provide a source of passive income through interest or rewards earned on your holdings.

Time Horizon

Your time horizon, or the length of time you intend to hold your investments, should also influence your choice of crypto index funds. If you’re investing for the long term, you may focus on index funds with a strategic approach and periodic rebalancing to capture the potential growth of the cryptocurrency market over time. For shorter time horizons or more active trading strategies, you may prefer index funds with a tactical focus and more frequent rebalancing to capitalize on short-term market opportunities and trends. These funds are designed to adapt quickly to changing market conditions and may appeal to traders seeking to profit from market volatility.

Trading Strategy

If you prefer a hands-off approach and aim to passively track the performance of the overall cryptocurrency market, you may opt for broad-based index funds that mirror the market’s composition. Alternatively, if you’re an active trader looking to capitalize on specific market trends or sectors, you may seek out thematic or sector-specific crypto index funds that offer targeted exposure to niche areas of the cryptocurrency market. These funds can allow you to exploit opportunities for outperformance in the broader market.

Choosing the most suitable crypto index funds for your characteristics requires careful consideration of your risk tolerance, investment objectives, time horizon, and trading strategy. By aligning your choices with your individual preferences and goals, you can construct a well-rounded and diversified portfolio that reflects your unique investment profile. Whether you’re a conservative investor seeking stability, a growth-oriented investor pursuing high returns, or an active trader looking to capitalize on market opportunities, Trakx’s platform provides all the Crypto Tradable Indices needed to meet your necessities. Conducting thorough research, seeking professional advice if needed, and staying informed about market developments will help you make informed investment decisions with confidence and critical thinking.

How to Buy A Crypto Tradable Index? Step-by-Step Guide

Investing in a crypto index fund offers a diversified approach to entering the cryptocurrency market, providing exposure to multiple digital assets through a single investment vehicle. If you want to start trading Crypto Tradable Indices, follow this step-by-step guide to start:

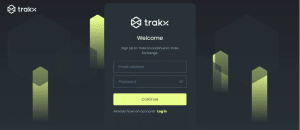

Step 1: Sign Up

The first step is to sign up on Trakx, a French fintech-regulated platform offering Crypto Tradable Indices. It provides a user-friendly interface for seamless trading.

Step 2: Email and Password

Once you’ve chosen a platform, register with your email and create a secure password. Ensure that your password is unique and contains a combination of special characters, numbers, and upper and lower case letters to enhance security.

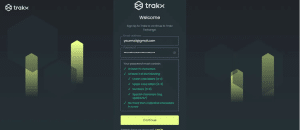

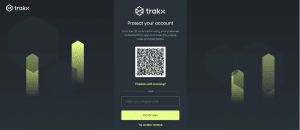

Step 3: Email Confirmation & 2FA

After completing the registration process, access your email inbox to verify your account. Click on the confirmation link provided in the email to proceed. To enhance the security of your account, enable two-factor authentication (2FA). This adds an extra layer of protection by requiring a second form of verification, such as a code sent to your mobile device, in addition to your password.

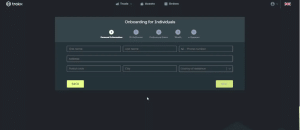

Step 4: Onboarding

Provide your details as part of the onboarding process. This may include your email, name, contact information, and any other required information. To comply with regulatory standards, you’ll need to verify your identity by providing the necessary documentation. This may include a government-issued ID, proof of address, and other relevant documents.

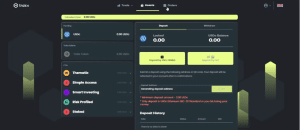

Step 5: Fund your Account

To start buying crypto index funds, finance your trading account by making a deposit in either fiat currencies or cryptocurrencies. Navigate to the ‘Assets’ section of the platform to initiate the deposit process. With these steps completed, you’re now ready to embark on your journey of investing in Crypto Tradable Indices.

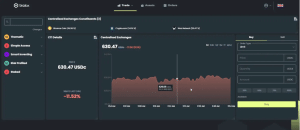

Step 6: Start Trading

Congratulations! You’ve successfully registered your account and can now start trading Crypto Tradable Indices on the platform. Remember to conduct thorough research, diversify your investments, and stay informed about market trends to make informed trading decisions. After that, explore the available indices and build your investment portfolio with security, knowledge, and critical thinking.

Risk Management in Crypto Index Trading

As you venture into investing in CTIs, adopting robust risk management strategies to navigate market uncertainties and mitigate potential losses is crucial. Here’s why risk management is paramount:

Preservation of Capital

As Warren Buffett once said: “First rule: Don’t lose money. Second rule: Don’t forget the first rule”. At the core of risk management is the preservation of capital. By implementing risk management techniques such as diversification, asset allocation, and position sizing, you can protect your investment capital from significant losses during market downturns or adverse events.

Mitigation of Volatility

Cryptocurrency markets are notorious for their high price volatility, which can result in rapid fluctuations and substantial portfolio swings. Effective risk management strategies, such as hedging and portfolio rebalancing, help mitigate the impact of volatility on your portfolio, allowing you to maintain a more stable investment trajectory over time.

Emotion Regulation

Emotions such as greed, and fear (including fear of missing out – FOMO) can cloud judgment and lead to impulsive investment decisions. Risk management strategies provide a rational framework for decision-making, helping you avoid emotional biases and adhere to your investment plan even during periods of market turbulence.

Long-Term Sustainability

Successful investing is not just about generating short-term profits but also about sustaining long-term wealth growth. By prioritizing risk management and focusing on capital preservation, you can build a resilient investment portfolio that withstands market fluctuations and delivers consistent returns over time.

Key Risk Management Practices

- Diversification: Spread your investment across multiple crypto index funds to reduce concentration risk and exposure to any asset or sector.

- Asset Allocation: Do not allocate your investment capital only in cryptocurrencies but also across different asset classes, such as stocks and bonds, based on your risk tolerance and investment objectives.

- Position Sizing: Establish the optimal size for each investment position in relation to your portfolio size and risk tolerance to manage exposure efficiently.

- Stop-loss Orders: Establish predetermined exit points for your trades to cap potential losses and safeguard your capital against adverse price movements.

- Continuous Monitoring and Adjustments: Regularly review your investment portfolio, assess market conditions, and adjust your risk management strategies accordingly to adapt to changing circumstances and optimize your investment outcomes.

By prioritizing capital preservation, mitigating volatility, protecting against downside risk, regulating emotions, and implementing key risk management practices, you can navigate the cryptocurrency market with confidence and achieve your long-term financial goals. Remember that while investing offers exciting opportunities, it’s essential to approach it with caution, discipline, and a well-defined risk management framework.

In conclusion, investing in Crypto Tradable Indices offers a promising avenue for both beginners and experienced traders. By diversifying your investments across various indices tailored to your risk tolerance, investment objectives, and trading strategy, you can build a well-rounded portfolio that reflects your personal characteristics and goals. As you embark on your investment journey, consider leveraging platforms like Trakx, a leader known for its disruptive technology, user-friendly interface, and comprehensive range of Crypto Tradable Indices. However, success in crypto index trading requires more than just selecting the right indices; it also demands diligent risk management to safeguard your capital and navigate market volatility effectively. By prioritizing risk management principles and staying informed about market developments, you can pave the way for long-term financial success in crypto.